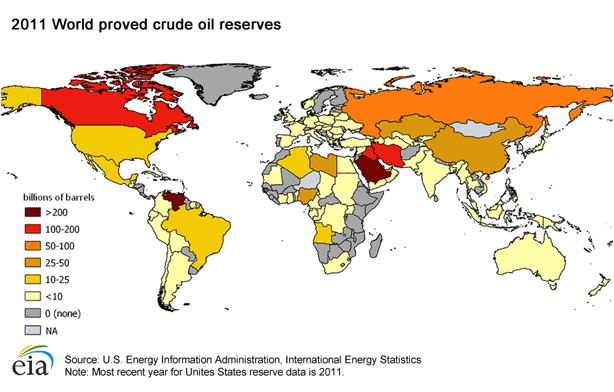

The world of oil production and distribution is complex and fierce. With over 1.5 trillion barrels in oil reserves and the average production rates coming out to about 89 million barrels a day, it’s no wonder that it’s such a popular market. Private companies and governments from all over the globe fight for local and global oil sales. However, in a world as competitive as this there are bound to be some players who are higher ranked than others, and they maintain the highest sales and production rates of them all.

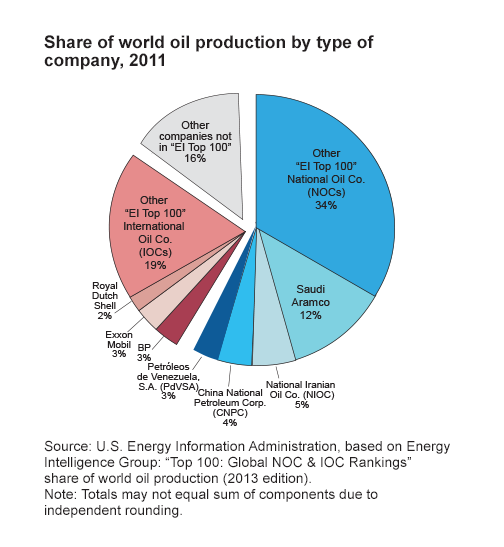

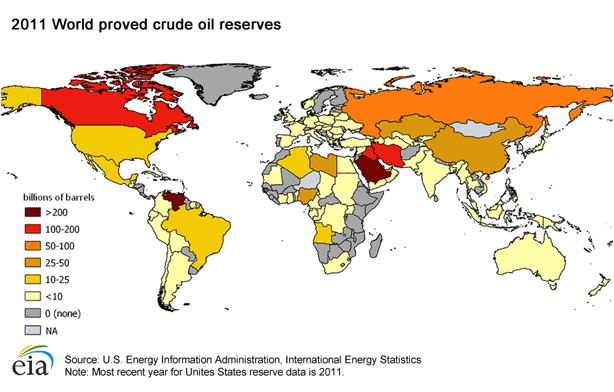

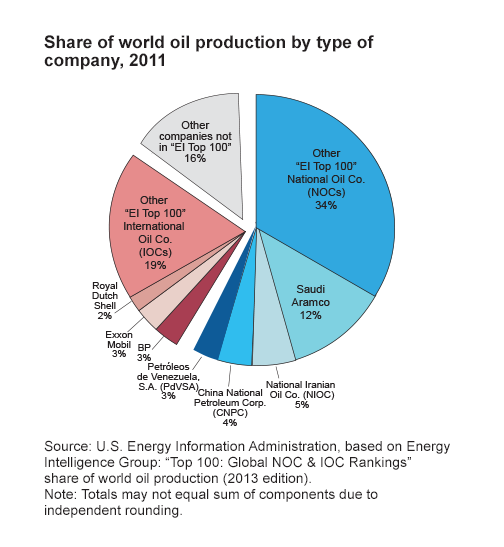

Government-owned national oil companies hold the top spot in both production and oil reserves. Oil companies that are backed by the government tend to have a different marketing strategy than international oil companies. Government-owned oil companies tend to have more of a focus on providing jobs for their citizens and providing more affordable energy than international oil companies. Despite not usually having a highly competitive intention with international oil companies, government-owned oil companies still hold the top spot in reserves and production. A study done in 2010 showed that government-owned national oil companies hold 85% of the world’s oil reserves and that they account for 58% of all oil production.

International oil companies adhere to government regulations on oil, but they are not backed by the government. Instead, these companies are backed by numerous shareholders who aim to sell their oil as fast and efficiently as possible. The intentions of these companies is usually to maximize profits for their shareholders and to do what is in the best interest of the company. Because of this, their prices tend to be somewhat higher than government-owned companies. International oil companies account for the remainder of the world’s oil reserves, which is about 15%. They also produce the rest of the oil for the world’s oil market by producing roughly 42% of the world’s oil.

Another major player is OPEC, which stands for the Organization of the Petroleum Exporting Companies. This is a group of some of the most oil-rich countries on the planet. While they mostly deal with the workings of government-owned national oil companies, the privately owned international oil companies are still allowed to work in their territory. OPEC owns around 73% of the world’s oil reserves, and they produced over 40% of the world’s oil in 2012. In addition, OPEC also accounts for over 60% of the overall oil that has been traded internationally thanks to having high producing countries such as Saudi Arabia, the largest exporter of oil in the world, in their group.

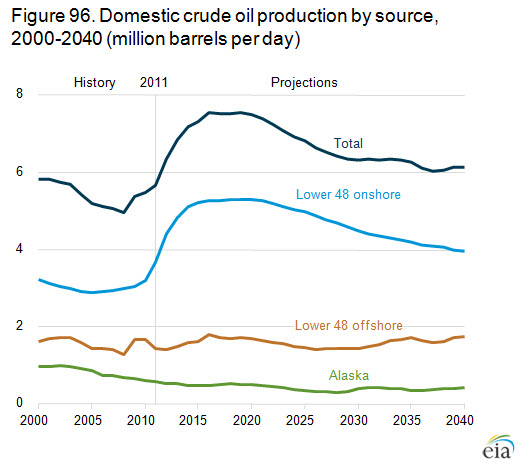

Jack Gerard, the CEO of the American Petroleum Institute, or API, spoke at a lunch for business leaders in New Orleans on Thursday, July 17. In his speech, Gerard called for policy changes on the part of the Obama administration in regard to its approach to energy policy.

Jack Gerard, the CEO of the American Petroleum Institute, or API, spoke at a lunch for business leaders in New Orleans on Thursday, July 17. In his speech, Gerard called for policy changes on the part of the Obama administration in regard to its approach to energy policy.